|

I understand the fear and restlessness - I am not above the market psychology but I am not reacting. Some lessons learned over the years are working for me.

Am I still buying? Absolutely and if you have a long-term time horizon you should be buying too. What should you be buying? The answer to that question is contingent on your financial IQ, risk threshold and time horizon. Once you determine your risk/reward profile and find appropriate asset classes to invest in - it is time to start investing. How much to save and how much to invest? And how to save? And how to invest ...

The bottomline folks is education, which leads to readiness and thereby risk mitigation. If the current market turmoil is a wakeup call - so be it. Use this opportunity to get smart about your financial IQ. Now is not the time to be reacting but taking deliberate actions to set your financial life in order. It takes time and effort but hey - it's your money!

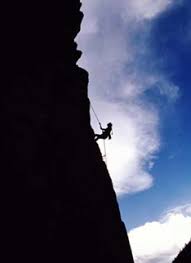

"As a rock climber, the one thing you learn is that those who panic, die on the mountain. You don't just sit on the mountain. You either go up or go down, but don't just sit and wait to get clobbered. If you go down and survive, you can come back another day. You have to ask the question, What can we do not just to survive but to turn this into a defining point in history?"

Jim Collins

If you enjoyed this post, consider subscribing to a full RSS feed or get regular updates via email.

Mark U Runta

Mark U Runta

1 comment:

Good advice, though I think how you invest is key. If you do want to dollar cost average, use index funds to lower your entry costs and diversify your risk basis.

Post a Comment