There are the "known unknowns" and then there are the "unknown unknowns". I don't want to speculate on either of the unknowns but invest in the market with the understanding that there are unknowns. The pros on Wall Street got hammered by the recent credit crunch losing billions. They had thought of all possible scenarios - guess there were still some unknowns.

There are the "known unknowns" and then there are the "unknown unknowns". I don't want to speculate on either of the unknowns but invest in the market with the understanding that there are unknowns. The pros on Wall Street got hammered by the recent credit crunch losing billions. They had thought of all possible scenarios - guess there were still some unknowns.

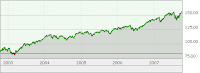

So where am I going with this. All the indexes are in record territory, records are being set every day and making money is becoming way too easy. Almost as easy as it was in the heady days of the new internet economy. Now it's the heady days of the global economy where issues in the US don't impact global growth (or at least not too adversely). So is it all doom and gloom around the corner. I don't know and instead of trying to predict the future I focus on the following

S&P 500 has doubled since 2003 (25% annual gain). The stock market average return is 8-10%. Law of large numbers dictates that we will revert to the mean over a period of time. Market corrections have happened in the past and will happen again.

S&P 500 has doubled since 2003 (25% annual gain). The stock market average return is 8-10%. Law of large numbers dictates that we will revert to the mean over a period of time. Market corrections have happened in the past and will happen again.- I am in this game for the long term. I invest periodically and avoid timing the market. I try to avoid extreme emotions and stay the course.

- An astute investor should be hedging their portfolio by periodically reviewing their assett allocation, being resonably diverified and expecting a reasonable rate of return over the long term.

References

Donald Rumsfeld - DoD Press Briefing

Mark U Runta

Mark U Runta

2 comments:

Hey - don't bring up out buddy Don!!!

Although I do agree that the market looks frothy and too eager to just keep going up up and up. Not that I don't like that but the more up it goes the more down it can go also ...

But isn't ignorance bliss. And you gotta love the comfort zone.

Excellent post - right on the mark. I need to wake up and take charge.

Post a Comment